The Persistence of Magical Thinking: Techno-speculation Goes After the Global South

Dear Reader,

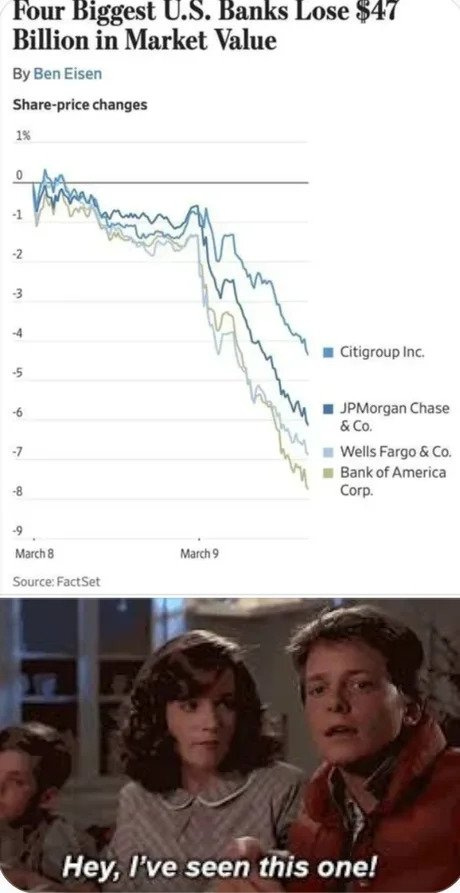

It has been an instructive few weeks. The implosion of Silicon Valley Bank (SVB), the creditor to the region’s many start-ups, signals a larger crisis in the making. Market actors are keenly tracking the incident, whose ripple effects are already being felt across the larger finance world. The SVB episode, which coincides with a brutal spate of layoffs within Big Tech ranks and their emulators sheds light on something many have not considered: that a critical motor driving Tech’s dynamism in recent years was an ‘easy money’, low-interest rate financial climate.

The bitter learnings from the 2008 financial crisis, combined with the institutional backing that the sector continues to command, have of course prompted rapid response and firefighting by the US government and Federal Reserve. This will perhaps go some way in mitigating the crisis. But the headwinds of change clearly point to further turmoil and a tightening fiscal environment, one that is less forgiving of excess and speculation, hallmarks of the tech sector.

So, is it curtains down for the era of magical thinking in digital capitalism?

Yes and no. Despite some acknowledgment of tech exceptionalism having run its course and the Global North working overtime to insulate itself from the aftermath, wild digital gambles — hatched in more permissive days — continue apace in the Global South. This month, our issue focusses on such projects and their local implications. Our first piece analyzes the investor push to give crypto a second lease of life by targeting political, social, and economic vulnerabilities in Africa. In our second piece, we engage with the specter of the largely defunct smart city narrative and the complex politics of digitalization, urbanism, and displacement in Kolkata.

The DataSyn Team

THE BIG EXCESS

Crypto Imperialism and Financial Inclusion in Africa

Olivier Jutel

Whatever happened to web3 evangelists in the wake of the recent scandals and turmoil within the space? It seems they are still hard at work, finding avenues and rhetorical strategies to redeem their brand. Olivier Jutel critically surveys the crypto-discourse as it surges through Africa, posturing itself, ironically, as an antidote to ‘financial colonialism’.

Read on.

THE NEW DIVERGENCE

From Land to Data: Value-extraction in Smart Cities

Ilia Antenucci

Smart cities have long been held up as an approaching hallmark of our utopian digital future. Yet the dynamics at work in these sites of urban enhancement portend something much darker. Drawing on a case study of New Town Kolkata, Ilia Antenucci unpacks the entangled forms of extractavism that are playing out within the smart city nexus.

Read on.

The Sins & Synergies Lounge

Silicon Valley Bank’s plummet is the second biggest bank collapse in US history, and it was all centered around Tech. What caused it? How much contagion is it likely to unleash? What are the measures being taken to deal with it? Listen in as Adam Tooze unpacks what we know so far.

The recent banking crisis is only the most recent in a spate of significant blows to the global tech industry over the last year. For a comprehensive overview of these challenges, check out Rest of World’s statistical portrait of the industry’s growing woes.

What are the underlying costs to nature, labor and society as Big Tech’s growing stranglehold on the digital economy ossifies? For an idea, we highly recommend TNI’s 2023 ‘State of Power’ Compendium that focuses this year on the theme of ‘digital power’.

As this year’s UN Commission on the Status of Women (CSW67) draws to a close, take a look at one of the milestone interventions from the proceedings, Development Alternatives with Women for a New Era (DAWN) and IT for Change’s recently released ‘Declaration of Feminist Digital Justice’.

What are the ways in which the state ends up aiding and abetting forms of techno-imperialism and extractivist dynamics in the developing world? Ulises Meijas reflects on these patterns of collusion and potential strategies to challenge them.

There is a great deal to worry about with respect to digitally managed ‘fast fashion’ supply chains that enable today’s ultra-low cost garments. Read this piece from WIRED that unpacks the dangerous costs underlying the business model of perhaps the biggest of such companies - the Chinese giant Shein.

Post-script

DataSyn is a free monthly newsletter from IT for Change, featuring content hosted by

Bot Populi. DataSyn is supported through the Fair, Green, and Global Alliance.

Liked what you read? To have such concise and relevant analysis on all things Big Tech delivered to your inbox every month, subscribe to DataSyn!